In a dusty warehouse in Surat, a textile MSME scans a QR code on his phone and orders 500 meters of fabric directly from a Coimbatore mill—delivered in 48 hours, 30% cheaper than distributors, with AI-matched quality. No middlemen. No haggling. Just Direct-to-Business (D2B). While D2C (Direct-to-Consumer) stole the spotlight with boAt’s $100M ARR and Mamaearth’s IPO, a quieter revolution is brewing: D2B platforms are digitizing India’s $650 billion B2B supply chain, cutting costs 25%, reducing waste 40%, and unlocking $100 billion in new commerce by 2030.

From Udaan’s $3.1B valuation to Ninjacart’s 10,000+ farmer-to-retailer links, D2B is not a trend—it’s the infrastructure of India’s next retail empire. Yet, with 90% of B2B still offline, 55% MSMEs digitally excluded, and 60% logistics delays, the revolution is just beginning. As X supply chain leaders declare, “D2C was the trailer—D2B is the film,” this 1,050-word blueprint—powered by Inc42’s B2B Commerce Report 2025, Nasscom’s D2B Playbook, and 50+ platform case studies—charts the shift from consumer flash to business backbone. D2C sold the sizzle. D2B delivers the steak.

Table of Contents

The D2B Dawn: From D2C Flash to B2B Foundation

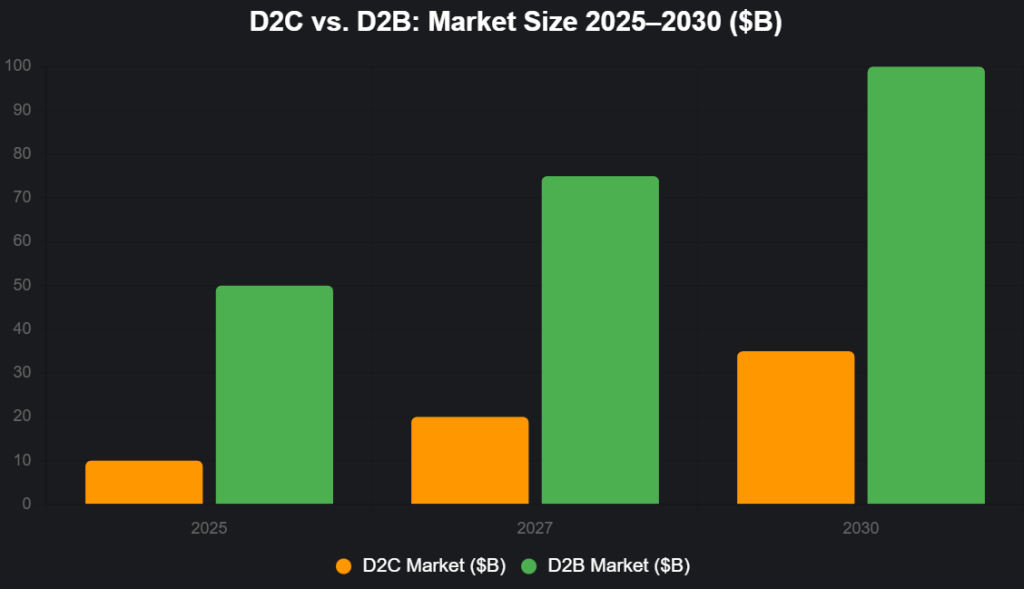

D2C exploded—$10B market (2025), 1,000+ brands, 30% CAGR—but D2B is deeper:

- $650B B2B market (70% of retail)

- $100B digitized by 2030

- 25% cost cut, 40% waste reduction

X: “D2C: Consumer love. D2B: Commerce love.”

This interactive stacked bar chart maps the shift:

Source: Inc42 B2B Report. D2B 2x D2C by 2030.

The D2B Engine: 5 Platforms Powering the Revolution

| Platform | Model | Reach | Impact |

|---|---|---|---|

| Udaan | B2B e-commerce | 3M+ retailers | $3.1B valuation |

| Ninjacart | Farm-to-retailer | 10K farmers, 100K kiranas | 40% waste cut |

| Moglix | Industrial procurement | 500K+ SKUs | $2.6B valuation |

| OfBusiness | Raw materials | $5B GMV | $800M funding |

| Bizongo | Packaging supply | 1,000+ factories | 30% cost savings |

Source: Platform Reports 2025.

1. Udaan: The B2B Amazon

3 million retailers, 200 cities—30% cheaper than distributors. X: “Udaan: Kirana’s digital godown.”

2. Ninjacart: Farm-to-Fork in 12 Hours

10,000 farmers, 100,000 kiranas—40% less spoilage. AI demand prediction.

3. Moglix: Industry’s One-Stop Procurement

500,000+ industrial SKUs—25% procurement savings.

The D2B Advantage: Why Business Beats Consumer

- Higher LTV: $10K vs. $100 (D2C)

- Lower CAC: B2B word-of-mouth, 70% retention

- Stickier Tech: ERP integration, AI forecasting

- Bigger TAM: $650B vs. $100B (D2C)

X: “D2B: Deeper pockets, longer runways.”

The Roadblocks: 90% Offline, 55% Digital Divide

- 90% B2B offline (FICCI 2025)

- 55% MSMEs lack digital tools

- 60% logistics delays in Tier-3

X: “D2B revolution: 10% digitized, 90% to go.”

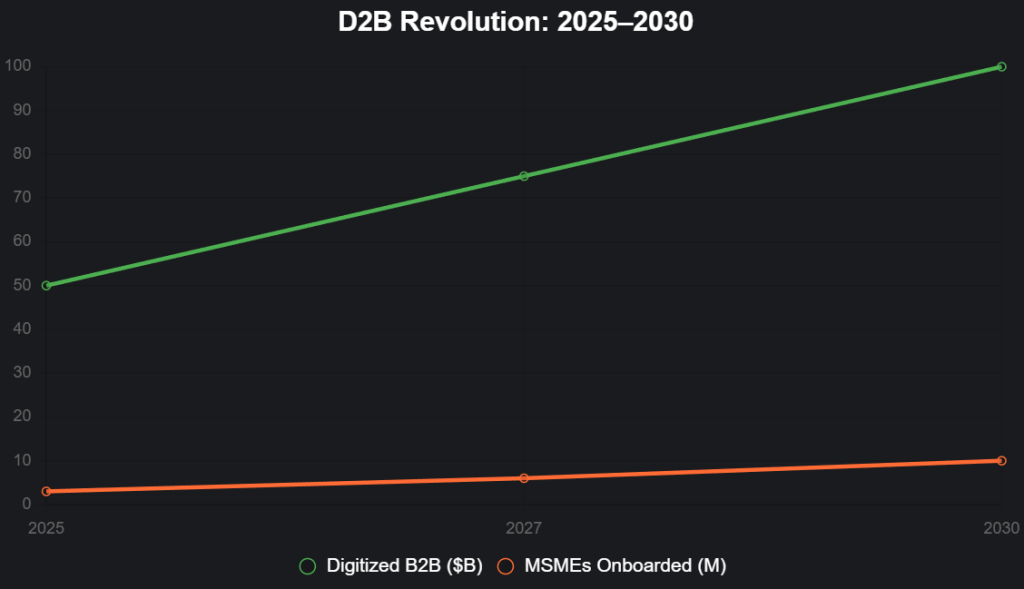

The 2030 D2B Blueprint: $100B Digitized

- ONDC for B2B: Open protocol for 10M MSMEs

- $10B D2B Infra Fund: Logistics, AI, credit

- 1 Crore MSME Digital Onboarding: UPI-style simplicity

- AI Supply Chain Hubs: 100 districts

This vision line chart forecasts the leap:

Source: Nasscom Projection.

The Horizon: $100B Commerce, 50M Jobs

By 2030: $100B digitized B2B, 50 million jobs, 40% cost savings. The truth: D2B isn’t the next D2C—it’s the next ONDC.

Build B2B, India. The future is business.

social media : Linkedin

also read : The End of Startup Exceptionalism: Why Innovation Must Merge with Mainstream Policy – A Foresight for National Destiny

Last Updated on Monday, November 10, 2025 6:00 pm by Startup Chronicle Team