January 2026: Indian startups are recalibrating their strategies as the investment climate grows more selective and disciplined. After years marked by record fundraising and soaring valuations, 2025–26 has introduced a period of heightened scrutiny, with investors placing renewed emphasis on profitability, sustainable growth, and operational resilience.

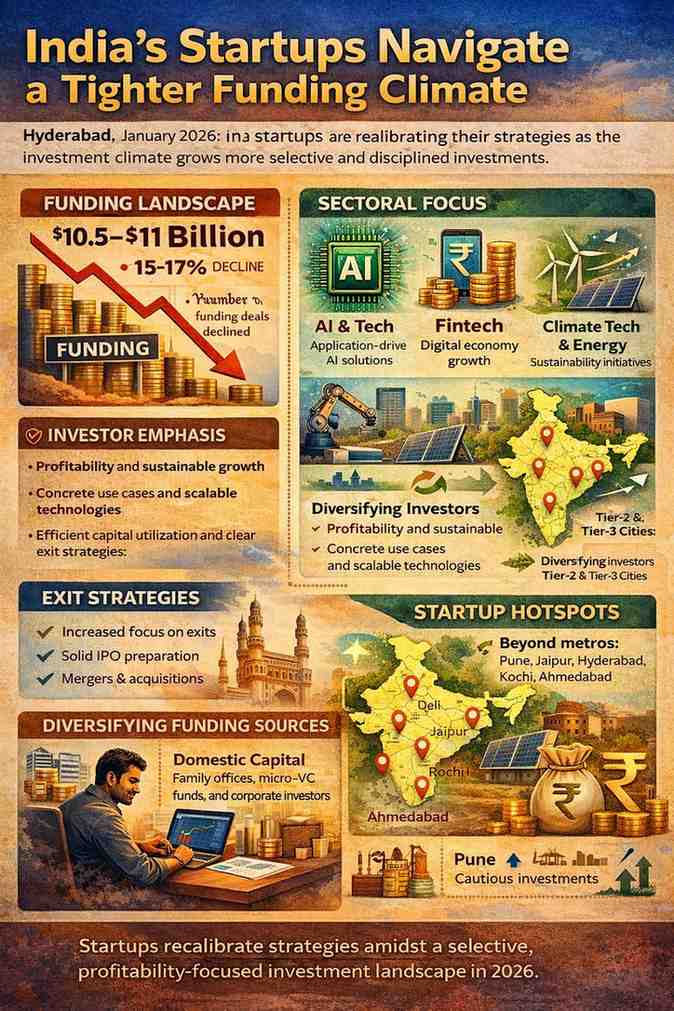

Industry reports indicate that total startup funding in India during 2025 amounted to approximately $10.5–$11 billion, reflecting a decline of 15–17 percent from the previous year. The number of funding deals fell sharply, highlighting an era of caution and discernment among venture capitalists. Early-stage deals, particularly at the seed level, experienced the steepest contraction, while startups with established product-market fit and demonstrable traction continued to attract investor attention. Experts note that investors are increasingly unwilling to fund businesses solely based on potential market size or ambitious vision, preferring to back ventures that show measurable progress and efficient capital utilization.

The technology sector, especially artificial intelligence, remains a central focus for investors, though the approach has shifted significantly. Venture capital firms are favoring application-driven AI solutions that address concrete operational or business challenges rather than purely experimental research models. Enterprise analytics, workflow automation, and industry-specific AI applications are emerging as the primary areas of investor interest, reflecting a broader preference for scalable technologies with tangible outcomes.

The sectoral landscape of funding is also diversifying. Fintech continues to attract significant capital, buoyed by India’s large digital economy and a regulatory environment conducive to innovation. At the same time, climate tech and clean energy ventures are drawing patient capital, supported by both private and public investors who recognize the long-term strategic value of sustainability-focused initiatives. Deep technology fields such as robotics, advanced manufacturing, and energy innovation are similarly gaining traction as investors seek ventures with long-term impact and fewer direct competitors globally. Consumer-focused startups are not left behind, as differentiated brands with proven market demand continue to secure meaningful investment.

Domestic capital is playing an increasingly prominent role in this evolving ecosystem. Family offices, micro-venture funds, and corporate strategic investors are stepping in where global venture funds are exercising caution. These domestic players are particularly active in early and mid-stage rounds, ensuring continuity for startups that demonstrate strong fundamentals.

The focus on profitability and sustainability has also renewed attention on exit strategies. Indian startups are preparing more seriously for initial public offerings and strategic mergers or acquisitions. Companies that demonstrate predictable revenue growth, clean financial statements, and robust governance practices are increasingly well-positioned to attract investor confidence for successful exits.

Geographically, investment is spreading beyond traditional metropolitan hubs. Tier-2 and Tier-3 cities, including Pune, Ahmedabad, Kochi, and Jaipur, are witnessing increased entrepreneurial activity and investor interest. These cities offer lower operational costs and expanding local markets, making them attractive destinations for startups seeking growth opportunities outside the established tech corridors.

Government initiatives such as Startup India and various state-level innovation programs continue to influence investment decisions by providing policy clarity and financial support. Founders and investors alike acknowledge that regulatory certainty plays a crucial role in shaping the sustainability and scalability of emerging businesses.

As India’s startup ecosystem transitions from an era of rapid capital influx to one defined by strategic discipline, founders are focusing on robust business models, efficient unit economics, and accountability, while investors continue to back ventures that deliver measurable value. This evolving environment signals a maturing entrepreneurial landscape in India, one that emphasizes resilience, strategic foresight, and sustainable growth, laying the foundation for the next chapter of innovation and market leadership.

Also Read: https://economicedge.in/the-rising-importance-of-customer-retention-for-indian-consumer-startups/

Add startupchronicle.in as a preferred source on Google – Click here

Last Updated on Thursday, January 22, 2026 7:04 am by Startup Chronicle Team