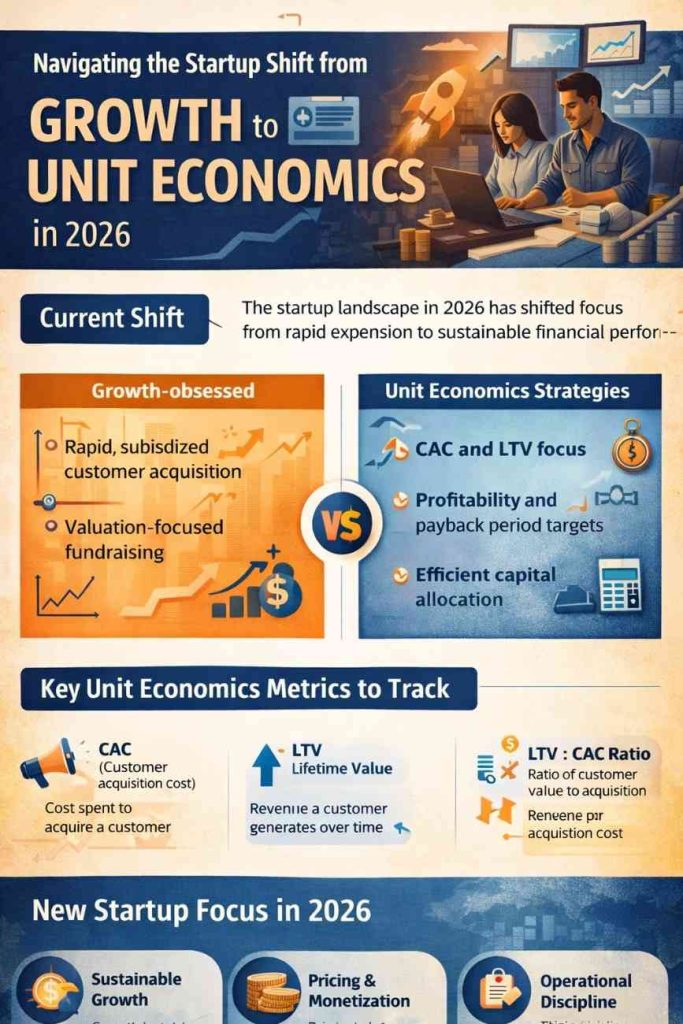

In 2026, the global startup ecosystem finds itself at a defining crossroads. After more than a decade dominated by aggressive expansion, rapid customer acquisition, and valuation-led narratives, a quieter but more consequential transition is underway. Growth, once treated as the ultimate marker of success, is now being scrutinized through a sharper lens. Founders and investors alike are asking a more fundamental question: does growth actually make economic sense?

This shift has not happened overnight. It is the cumulative result of funding cycles tightening, public market corrections, and the hard lessons learned from startups that scaled quickly but collapsed under unsustainable cost structures. In this new environment, unit economics has moved from a finance slide buried deep in pitch decks to the very center of strategic decision-making.

For years, capital abundance allowed startups to prioritize speed over sustainability. Customer acquisition was subsidized, margins were postponed, and profitability was framed as a future problem. As long as user numbers rose and markets expanded, inefficiencies were tolerated. By 2026, that tolerance has disappeared. Capital is more selective, boards are more demanding, and founders are being forced to confront the true cost of growth.

Unit economics, at its core, answers a simple but uncomfortable question: does each customer, transaction, or product create value or destroy it? It measures the relationship between what it costs to acquire and serve a customer and what that customer ultimately contributes in revenue. When this balance is negative, scale becomes a liability rather than an advantage. Many startups learned this too late during previous downturns, discovering that growing faster only meant losing money faster.

What distinguishes the 2026 landscape is that unit economics is no longer treated as a maturity-stage concern. Early-stage startups are being evaluated on how quickly they understand and control their underlying economics. Founders are expected to demonstrate not just product-market fit, but economic viability at a granular level. Investors want evidence that growth can eventually translate into profits without requiring endless infusions of capital.

This has fundamentally altered how startups think about expansion. Growth is no longer about capturing the largest possible audience at any cost. It is about acquiring the right customers through channels that are efficient, repeatable, and measurable. Marketing strategies have shifted away from heavy discounting and incentive-driven acquisition toward retention-focused approaches that maximize long-term value. In many cases, slower and more deliberate growth is proving more powerful than rapid but fragile scaling.

Pricing strategies have also undergone a quiet revolution. In earlier years, underpricing was often used as a weapon to gain market share. In 2026, startups are more willing to price for value, even at the risk of growing more slowly. Subscription models are being refined, usage-based pricing is becoming more common, and monetization is increasingly aligned with actual customer outcomes rather than vanity metrics.

Operational discipline has emerged as another defining feature of this era. Hiring plans are being tied closely to revenue contribution rather than optimistic projections. Product roadmaps are shaped by customer willingness to pay, not just engagement metrics. Even technology choices are being evaluated through a cost-efficiency lens, as founders recognize that infrastructure decisions made early can significantly impact margins at scale.

For many founders, this transition requires a mindset shift. Growth is no longer the reward; it is the responsibility. Scaling a business without strong unit economics is now widely seen as a strategic failure rather than an ambitious gamble. The most respected startups of 2026 are not necessarily the loudest or the fastest-growing, but the ones that demonstrate clarity, control, and consistency in how they create value.

Investors, too, have adapted to this reality. Funding conversations are increasingly centered on payback periods, contribution margins, and paths to profitability. While long-term vision and market potential still matter, they are expected to be supported by credible economic fundamentals. Startups that can show disciplined growth often find themselves in stronger negotiating positions, able to raise capital on better terms or extend their runway without immediate dilution.

The broader implication of this shift is a healthier startup ecosystem. Businesses built on sound unit economics are more resilient to market volatility, more capable of weathering downturns, and better positioned to deliver lasting value to customers and employees alike. While the era of easy money may be over, what replaces it is not stagnation but maturity.

As 2026 unfolds, the startups that succeed will be those that understand that growth and unit economics are not opposing forces. When aligned correctly, they reinforce each other. Sustainable growth is no longer about chasing scale blindly; it is about building systems where every unit added strengthens the business rather than weakening it. In this new chapter of entrepreneurship, discipline is not a constraint on ambition. It is the foundation that allows ambition to endure.

Also Read : https://businessbyte.in/7-government-subsidy-schemes-for-msmes-launching-in-q1-2026/

Add startupchronicle.in as preferred source on google – Click Here

Last Updated on Tuesday, February 3, 2026 1:27 pm by Startup Chronicle Team