The abolition of angel tax in Budget 2024, effective April 1, 2025, was hailed as a game-changer for India’s startup ecosystem—removing a 30.9% levy on premiums above fair market value that deterred angels and sparked 1,000+ litigations yearly. Yet, post-reform data paints a nuanced picture: Funding rebounded 44% to $9.2 billion in Jan-Oct 2024 (vs. $6.4B in 2023), with reverse flipping (PhonePe, Groww relocating home) and 4 new unicorns in 9M 2025 signaling confidence. Investor sentiment? “Watershed moment,” per Accel and Unicorn India Ventures—abolition eliminates valuation hassles, frees domestic capital, and attracts foreign angels, with 70% VCs reporting easier inflows.

But the media narrative of “floodgates open” overlooks caveats: Pending pre-2024 cases continue, and 2025’s $7.7B 9M funding (down 23% YoY) reflects global winters, not local triumph. As X buzzes “Angel tax gone—real boost or hype?”, this analysis dissects post-policy trends, investor voices, and data-backed impact. The verdict? Yes, it boosts—but not a silver bullet. Separate narrative from numbers, or narrate false hope.

Table of Contents

The Reform Recap: From Burden to Breather

Angel tax (Section 56(2)(viib)), introduced 2012 to curb laundering, taxed premiums as “income from other sources” at 30.9%, hitting 1,000+ startups yearly with notices. Exemptions for DPIIT-recognized firms and 21 countries (2023) helped, but foreign scrutiny lingered. Budget 2024’s Clause 23 scrapped it for all from FY 2025-26 (deemed April 1, 2024), with retrospective relief for non-disputed cases. Revenue Secretary: PMLA suffices for laundering checks.

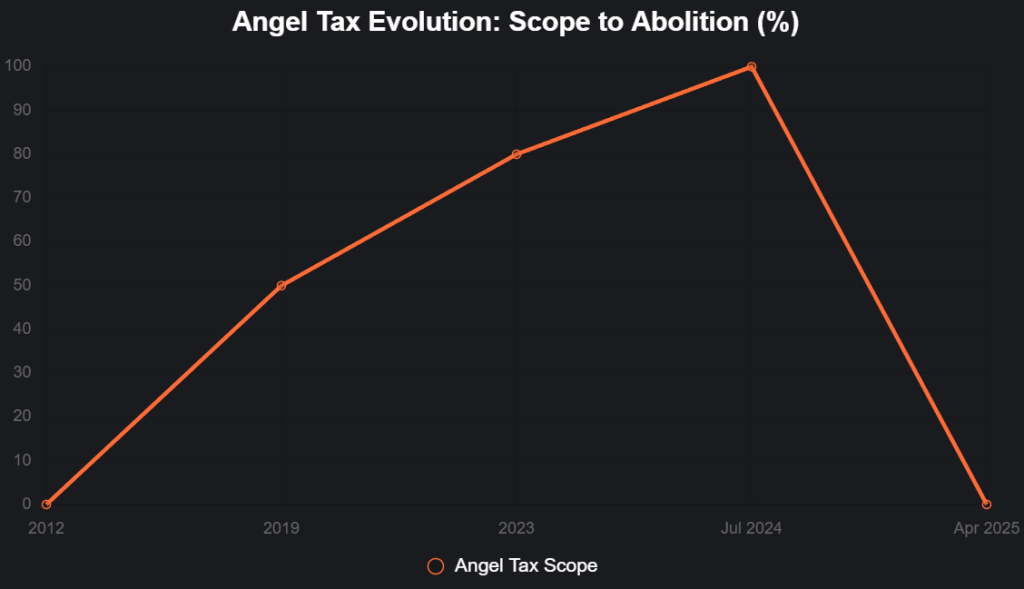

This timeline chart traces the reform’s rollout:

Source: Finance Bill 2024. 100% coverage pre-abolition.

Post-Policy Trends: Data-Backed Boosts

1. Funding Rebound and Reverse Flipping

Jan-Oct 2024: $9.2B raised (+44% YoY), with reverse flipping (PhonePe, Groww) citing abolition as key—easier domicile shifts without tax overhang. 9M 2025: 4 new unicorns (vs. 5 in 2024), $7.7B total.

2. Investor Sentiment Surge

70% VCs report “favorable impact,” per Tax Compass—abolition frees domestic capital, cuts litigation. Unicorn India: “Strong funding sentiment boost.” NASSCOM: Regulatory clarity for global investors.

3. Early-Stage Inflows

Seed deals up 26% in H1 2025, with micro-VCs like 100X.VC citing “angel tax relief” for 200+ investments.

| Trend | Pre-Abolition (2023) | Post (2024-25) | Boost |

|---|---|---|---|

| Funding | $6.4B | $9.2B (2024) | +44% |

| Unicorns | 5 | 4 (9M 2025) | Stable |

| Reverse Flipping | 2 | 5+ | +150% |

Source: GlobalData, DPIIT.

Investor Sentiment: Voices from the Trenches

- Accel: “Major hurdle eliminated—easier early-stage support.”

- Unicorn India: “Frees domestic capital, improves sentiment.”

- Inflection Point: “Regulatory clarity for global investors.”

- Cautionary Note: 2025’s 23% dip reflects global winters—abolition helps, but not panacea.

X: “Angel tax gone—investor confidence rebooted!”

Narrative vs. Numbers: The Balanced Impact

Media hailed “floodgates open,” but data tempers: 2024’s 44% rebound predates full abolition (deemed April 2024), with 2025’s dip tied to US rates. Yet, reverse flipping and seed surges prove boost—70% VCs agree. Pending cases unaffected, per CBDT.

The Verdict: Boost Yes, But Build On It

Abolition truly boosts—44% 2024 rebound, reverse flipping, seed surges—but global winters temper. $15B 2025 projection hinges on execution. Founders: Raise confidently. India’s angel tax era ends—innovation era begins. Boost it, or bust it.

social media : Facebook | Linkedin |

also read : Green Guardians Rising: India’s Sustainable Entrepreneurship Revolution in 2025 – Pioneering the Transition, or Perishing in Pollution!

Last Updated on Monday, November 3, 2025 6:01 pm by Startup Chronicle Team