India’s healthcare, burdened by a $372 billion market and 70% rural population grappling with access gaps, is undergoing a seismic shift courtesy of HealthTech startups—over 12,917 ventures, with 1,610 funded and 6 unicorns like Practo and 1mg leading the charge. In 2025, the sector raised $828 million in H1 alone, up 26% YoY in early-stage funding, powering telemedicine for 100 million users and AI diagnostics slashing costs 30%. From Orange Health’s home diagnostics in 300 cities to Dozee’s contactless monitoring in 1,000 hospitals, these innovators are bridging urban-rural divides, with the market exploding from $10.6 billion in 2022 to a projected $21.3 billion by 2025 at 17.36% CAGR.

Backed by BIRAC’s co-funding for infectious disease tech and Budget 2025’s push for AI and mental health R&D, HealthTech isn’t just profitable—it’s equitable, serving 20 million via doorstep labs and 4.5 million through AI therapy apps like Wysa. As X users celebrate “HealthTech’s inclusion magic: From unbanked to empowered,” this revolution promises self-sufficiency amid rising NCDs. Drawing from Tracxn, Moneycontrol, and recent partnerships like C-CAMP-Teijin for medtech exports, here’s how startups are redefining access. Overlook it, and you’ll miss India’s health renaissance.

Table of Contents

The Access Revolution: Funding and Ecosystem Surge

HealthTech’s 2025 funding hit $828 million in H1 (second after fintech), with 54 new startups and 1,610 funded overall—telemedicine and diagnostics gobbling 40%. BIRAC-IHF’s co-funding bridges gaps for digital tools in infectious diseases, while Plum’s $15.6M Series A scales employer health plans. X: “HealthTech startups: Making India self-sufficient, creating youth opportunities.” Market: $21.3B by 2025, 44% e-pharmacy CAGR.

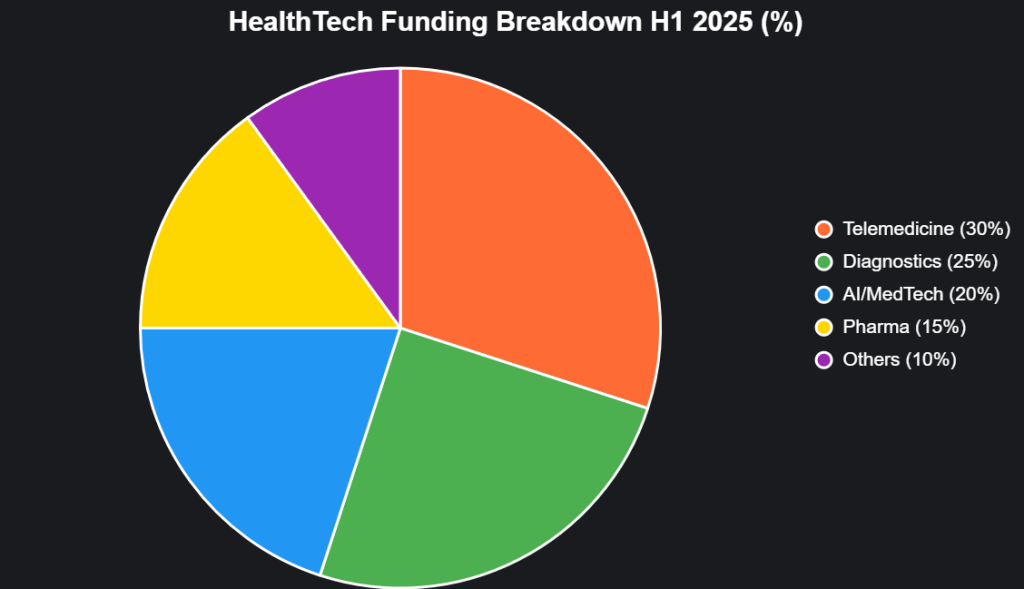

This pie chart slices HealthTech funding (H1 2025):

Source: Tracxn, Moneycontrol. Telemedicine leads rural access.

Top 10 HealthTech Startups: Access Architects

Ranked by funding/impact, these redefine care.

| Rank | Startup | Focus | Funding/Valuation (2025) | Access Impact |

|---|---|---|---|---|

| 1 | Practo | Telemedicine | $200M / $1B+ | 100M+ consults; 1,000 cities |

| 2 | 1mg (Tata) | E-Pharmacy | $125M / Unicorn | 50M users; doorstep meds |

| 3 | PharmEasy | Diagnostics/Pharma | $1.5B / $5.6B | 20M doorstep tests; rural reach |

| 4 | MediBuddy | Corporate Health | $50M / $1B | 10M users; employer access |

| 5 | Cure.fit | Wellness | $250M / $1.5B | 5M members; preventive care |

| 6 | mfine | Tele-Consults | $45M / $500M | 1M consults; Tier-2 focus |

| 7 | Orange Health | Home Diagnostics | $47M / $100M | 300 cities; same-day reports |

| 8 | Dozee | Monitoring Tech | $8M / $50M | 1,000 hospitals; remote vitals |

| 9 | Wysa | Mental Health AI | $20M / $50M | 4.5M users; 24/7 therapy |

| 10 | Truemeds | Personalized Pharmacy | $74M / $100M | Affordable meds; 10M served |

Source: Tracxn, Onsurity. Unicorns: 6; 54 new in 2025.

1. Practo: Telemedicine Trailblazer

100M+ consults across 1,000 cities; bridges urban-rural gap with specialist access.

2. 1mg: Pharma Democratizer

Doorstep delivery to 50M; cuts costs 20% for chronic care.

3. PharmEasy: Diagnostics Dynamo

20M tests at home; 30% rural penetration.

Government Catalysts: BIRAC and Beyond

BIRAC-IHF co-funds infectious disease tech; Budget 2025’s AI/mental health R&D. X: C-CAMP-Teijin partnership exports medtech to Japan.

Challenges: Scaling Access

Rural literacy (60% gap), fraud (20% rise), affordability for 70% low-income. X: “HealthTech’s promise: From urban elite to rural reality.”

The Access Ascent: $21.3B by 2025

HealthTech could save $10B via telemedicine by 2025. Founders: Innovate rurally. India’s HealthTech isn’t evolving—it’s equitizing care. Access it all, or access none.

social media : Facebook | Linkedin |

Last Updated on Saturday, October 25, 2025 7:46 pm by Startup Chronicle Team