As the Union Budget 2026 approaches, India’s startup ecosystem is entering a moment of quiet but intense scrutiny. After more than a decade of rapid growth, global capital inflows, and regulatory experimentation, Indian startups are no longer asking only for incentives. They are asking for stability, predictability, and policy clarity that matches their scale and ambition. For founders navigating slower funding cycles, rising compliance costs, and fierce global competition, Budget 2026 is being seen as a defining test of whether India’s policy framework is ready for its next phase of innovation-led growth.

Across sectors ranging from SaaS and fintech to deep-tech, AI, climate tech and manufacturing-led startups, conversations ahead of the Budget have converged around a small set of issues that could materially shape decision-making over the next three to five years. While the expectations are diverse, five policy areas stand out as the most closely watched by founders and investors alike.

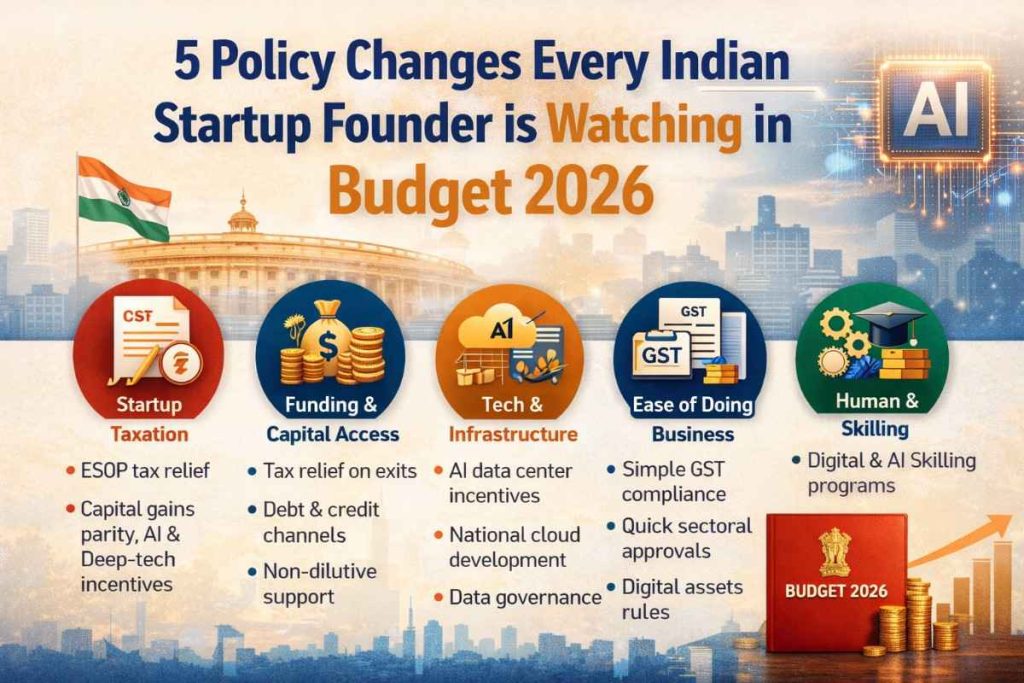

The first is startup taxation, particularly the long-standing demand for reform around employee stock options and capital gains. For many founders, ESOPs are no longer a perk but a core hiring and retention tool in a highly competitive talent market. Yet the current tax structure continues to impose a burden on employees at the time of exercising options, often years before any actual liquidity event. This has weakened the attractiveness of startup compensation, especially when compared to overseas markets. Founders are hoping Budget 2026 will move towards a more rational framework where taxation aligns with actual wealth creation, ideally at the point of sale rather than exercise. Alongside this, there is a strong push for clarity and parity in capital gains taxation for unlisted shares, a move that could significantly boost domestic participation in startup investments and exits.

The second area of focus is access to capital, especially beyond traditional venture equity. While government-backed funding initiatives have helped stabilise early-stage investing, founders are increasingly vocal about the need for a more mature and diversified capital ecosystem. In an environment where global venture capital has become more cautious, startups are seeking better access to domestic long-term capital, credit guarantees, and structured debt instruments. Non-dilutive funding support, particularly for research-heavy sectors such as AI, semiconductors, space technology and climate innovation, is also seen as critical. For many founders, the next phase of growth depends not just on raising money, but on raising the right kind of money at the right cost.

Technology and digital infrastructure form the third major theme shaping expectations from Budget 2026. As India pushes to become a global hub for artificial intelligence and advanced digital services, startups are watching closely for policy signals around data centres, cloud infrastructure, sovereign AI capabilities and energy costs. Affordable access to computing power, reliable digital public infrastructure and clear data governance frameworks are increasingly viewed as essential inputs for innovation, on par with roads and ports in earlier industrial phases. Founders believe targeted incentives in this space could lower operating costs, accelerate product development and strengthen India’s position in the global technology value chain.

Equally important is the fourth concern: ease of doing business and regulatory simplification. Despite improvements over the years, compliance continues to consume disproportionate time and resources for young companies. Frequent reporting requirements, complex GST procedures and overlapping regulations across sectors have added to operational friction. Startup leaders are hoping Budget 2026 will move decisively towards simpler, technology-driven compliance systems and clearer sector-specific guidelines, particularly in emerging areas such as fintech, digital assets and cross-border services. For founders, regulatory certainty is no longer just about convenience; it directly affects investor confidence and long-term planning.

The fifth and perhaps most strategic issue is human capital. India’s startup success story has always been talent-driven, but the demand for specialised skills in AI, data science, advanced manufacturing and deep-tech is now outpacing supply. Founders are watching for Budget announcements that strengthen skilling initiatives, industry-academia collaboration and targeted programmes for future-ready technologies. Investments in education, research institutions and inclusive talent pipelines are seen as essential not only for startups but for India’s broader competitiveness in a rapidly shifting global economy.

Taken together, these five policy areas reflect a broader transition underway in India’s startup ecosystem. The focus is shifting from speed to sustainability, from incentives to institutions, and from short-term boosts to long-term confidence. Budget 2026 is therefore not just another annual financial exercise for founders; it is a signal of how seriously India intends to support innovation at scale.

As the Finance Minister prepares to present the Budget, startup founders across the country are watching closely, not for grand announcements alone, but for thoughtful reforms that acknowledge how far the ecosystem has come and how complex its challenges have become. In many ways, Budget 2026 will reveal whether India is ready to move from being a fast-growing startup nation to a globally competitive innovation economy.

Add startupchronicle.in as preferred source on google – Click Here

Last Updated on Friday, January 30, 2026 9:13 am by Startup Chronicle Team