In India’s startup saga, where 195,065 DPIIT-recognized ventures propel a $450 billion digital economy, impact investing is no longer a niche altruism—it’s a powerhouse, surging from $4.1 billion in cumulative deals over six years to a projected $6-8 billion annual deployment by 2025, growing at 20-24% CAGR, per McKinsey. This blend of financial returns and measurable social/environmental good—targeting sectors like climate tech, education, and financial inclusion—has touched 60-80 million lives yearly, with 243 equity deals in 2020 alone signaling maturity.

Backed by the India Impact Investors Council (IIC)’s 2024 report of $4.96 billion across 438 impact enterprises in agriculture, health, and edtech, and trends like gender-lens and debt investing, impact funds are democratizing capital for underserved innovators. Yet, challenges like measurement gaps and scalability persist. As X users hail “Impact investing: From philanthropy to powerhouse,” this deep dive unpacks the rise, trends, and transformative potential. Embrace it, or let India’s $1 trillion innovation economy pass you by.

Table of Contents

The Surge: From $1 Billion to a $8 Billion Powerhouse

Impact investing in India crossed $1 billion in 2015, exploding to $4.96 billion in 2024 across 438 enterprises, per IIC’s “2024 in Retrospect,” with agriculture, climate tech, and financial inclusion leading. McKinsey’s 2017 forecast of $6-8 billion by 2025 holds firm, driven by 20-24% CAGR and blended finance models. Global momentum—$300 billion market by 2020—mirrors India’s, with family offices transitioning from philanthropy to structured impact, unlocking legacy-aligned innovation. In 2025, 30 IIC members deploy $2.6 billion annually, with 13 exits in 2020 yielding 10-12% median returns and top-quartile 34% IRR. X: “Impact investing: Social good meets strong ROI—India’s next unicorn wave.”

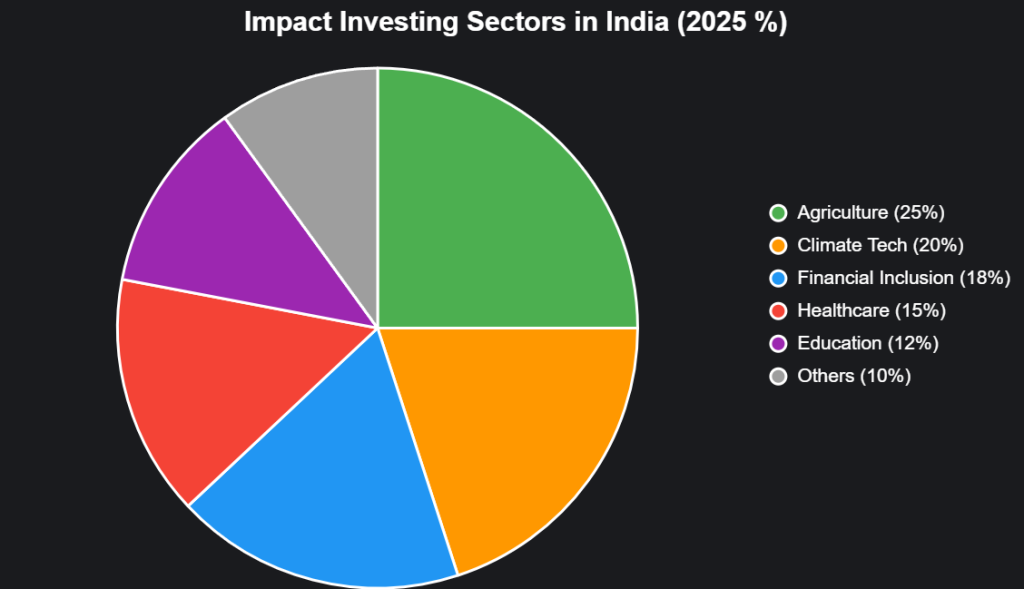

This pie chart breaks down impact sectors (2024 data, projected 2025):

Source: IIC Report 2024. Agriculture leads, empowering 1.5M farmers.

Key Trends: Blended Finance and Gender Lens Lead the Charge

2025’s impact landscape spotlights innovative financing: Blended models—philanthropy + VC—fund high-risk social ventures, with debt investing rising 25% for affordable housing and disability inclusion, per IIC. Gender-lens investing targets women-led startups (46% of 73,000), closing the 10% digital finance gap. AI/ML enhances impact measurement, forecasting outcomes in edtech and health, while microfinance in India/Bangladesh/Indonesia accesses capital for SMEs. Family offices, per IIC-Waterfield’s “Legacy to Leverage,” shift to impact capital, aligning wealth with SDGs. Globally, SOCAP/GIIN conferences echo Asia’s rise, with India’s renewable push (500 GW by 2030) drawing $13.1B. X: “Impact funds: Blending profit with purpose—India’s 2025 edge.”

Impact Trends Table (2025)

| Trend | Description | Growth Driver | Example Impact |

|---|---|---|---|

| Blended Finance | Philanthropy + VC for social ventures | 25% rise in debt | $4.96B across 438 enterprises |

| Gender-Lens Investing | Women-led focus | Closes 10% finance gap | 73K women-led startups |

| AI/ML Measurement | Data-driven outcomes | Enhances forecasting | Edtech/health ROI 34% |

| Microfinance Expansion | SME capital access | 20-24% CAGR | Bangladesh/India models |

| Family Office Shift | Legacy to impact capital | Blended models | $6-8B by 2025 |

Source: IIC, McKinsey.

Spotlight: Impact Startups Making Waves

- Aavishkaar Capital: $100M+ in agri/financial inclusion; 10-12% returns, 60M lives touched.

- LeapFrog Investments: $2B in emerging markets; 34% top IRR via health/edtech.

- Omidyar Network India: Blended finance for social enterprises; 243 deals in 2020.

X: “Impact investing: Where profit meets purpose—India’s $8B frontier.”

Challenges: Scaling Impact Amid Scrutiny

Measurement gaps plague 50% funds, with scalability hurdles in rural sectors (40% access lag). Regulatory flux and 15% commercialization rate slow progress, but AI tools promise 34% IRR tracking.

The Impact Imperative: $8 Billion by 2025

Impact investing could touch $8 billion by 2025, minting 150 unicorns with social punch. Investors: Blend boldly. Founders: Measure meaningfully. India’s rise isn’t just financial—it’s purposeful. Invest in impact, or invest in irrelevance.

social media : Facebook | Linkedin |

Last Updated on Monday, October 27, 2025 6:38 pm by Startup Chronicle Team