India’s startup exits are shedding their wild-west skin, evolving from the frothy frenzy of 2021’s 45 unicorn births into a more mature, metrics-driven marketplace where IPOs aren’t just liquidity lotteries—they’re strategic milestones for sustainable scaling. In 2025, with 13 new-age tech firms already listing (raising $3.4 billion cumulatively, up 142% YoY), the public markets beckon 23+ startups eyeing $6.4 billion, per Inc42’s IPO Tracker.

From Groww’s blockbuster $6.6 billion debut (29% premium, $91.5 billion cap) to PhysicsWallah’s $3.48 billion edtech offering (opening November 11), the wave signals investor appetite for profitability over promise—14 of 123 unicorns now profitable (up from 8 in 2024). Yet, risks loom: 18 post-IPO stocks trading at lows (e.g., Ola Electric down 74%), FII outflows pressuring valuations (down 15% YoY to $1.8 billion average), and a 90% failure rate underscoring the high-stakes gamble.

As X VCs debate, “2025 IPOs: Exit euphoria or efficiency test?”, this analysis explores the landscape, risks, and signals for funding cycles, revealing a $20 billion 2025 pipeline that could recycle $10 billion into early-stage bets, fostering a $1 trillion innovation economy by 2030. The wave isn’t crashing—it’s cresting for the disciplined.

Table of Contents

The Evolving IPO Landscape: From Frenzy to Focus

2024’s 13 listings ($3.4 billion) set the stage for 2025’s surge: 23+ startups (up 77%), targeting $6.4 billion, per Inc42. Q3 2025 saw $2.1 billion across 240 deals (down 38% YoY but stable QoQ), with IPOs driving 20% of exits ($1.8 billion, up from $700 million 2022). Bengaluru leads (51 unicorns), but Gurugram/Mumbai (20 each) diversify. Fintech dominates (19 unicorns, $50.1 billion value), but edtech (PhysicsWallah) and e-commerce (Meesho’s $800 million nod) signal breadth. Valuations? Cautious: $1.8 billion average (down 15% from 2024), reflecting 51% VCs eyeing profitability (Inc42 survey). X: “2025 IPOs: 23+ firms, $6.4B—focus on EBITDA, not euphoria.”

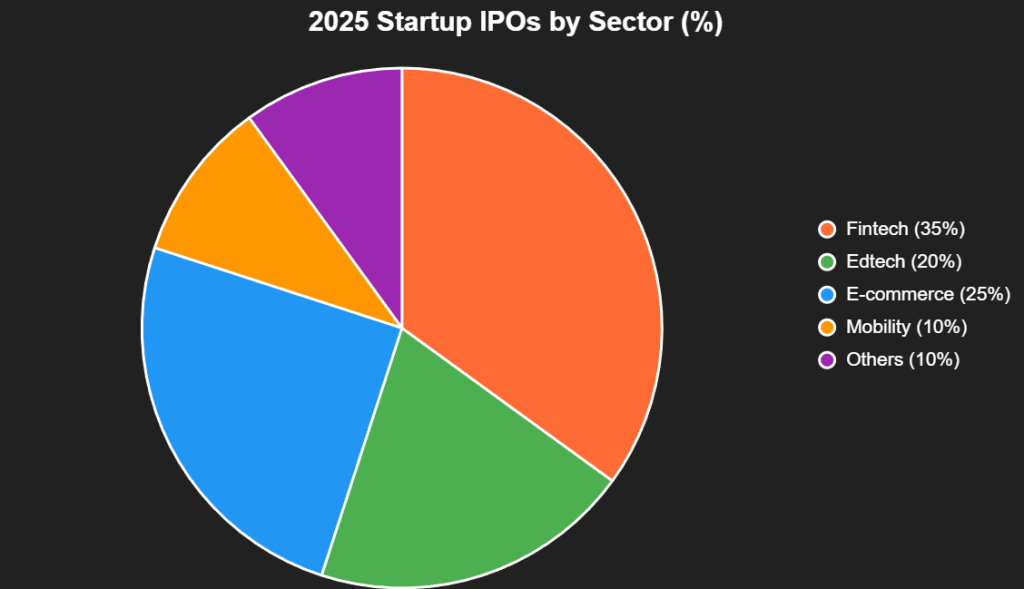

This pie chart dissects 2025’s IPO sectors:

Source: Inc42 Tracker 2025. Fintech 35% of pipeline.

Spotlight: 2025’s Wave-Makers – Profiles & Valuations

1. Groww (Fintech) – $91.5 Billion Cap

Bengaluru’s Groww debuted November 12 with ₹6,632 crore ($800 million) IPO (29% premium to ₹100, closing ₹128.85). 11.9 million clients, 26.3% broking share, ₹3,902 crore FY25 revenue (up 49%). Signal: Retail investing’s maturity—first post-flip IPO.

2. PhysicsWallah (Edtech) – $3.48 Billion IPO

Alakh Pandey’s platform opens November 11 (closes 14), ₹3,480 crore ($420 million) with ₹3,100 crore fresh, ₹380 crore OFS. 10 million users, 62% score uplift. Valuation: $3-4 billion est. Implication: Edtech’s profitability pivot (from Byju’s woes).

3. Meesho (E-commerce) – $800 Million Nod

SEBI-approved December 2025, ₹6,500 crore ($780 million) for Tier-2/3 expansion. 100 million users, first pure-play e-comm IPO. Valuation: $4-5 billion. Market mean: B2B/B2C resilience.

4. Lenskart (Consumer) – ₹8,000 Crore Nod

SEBI greenlight October 2025, ₹8,000 crore ($960 million) mid-November. 50 million users, 1,000 stores. Valuation: $5 billion. Signal: Offline-online hybrid’s appeal.

5. Tata Capital (Fintech/Financials) – ₹15,512 Crore Giant

₹15,512 crore ($1.86 billion) price band ₹310-326 (discount to ₹735 unlisted). 4th largest IPO. Implication: Traditional players’ tech infusion.

| Startup | Sector | IPO Size ($M) | Valuation Est. ($B) | Key Signal |

|---|---|---|---|---|

| Groww | Fintech | 800 | 91.5 | Retail maturity |

| PhysicsWallah | Edtech | 420 | 3-4 | Profitability pivot |

| Meesho | E-comm | 780 | 4-5 | Tier-2 expansion |

| Lenskart | Consumer | 960 | 5 | Hybrid model |

| Tata Capital | Fintech | 1,860 | 16.6 | Traditional tech |

Source: Inc42, SEBI Filings 2025. $6.4B total pipeline.

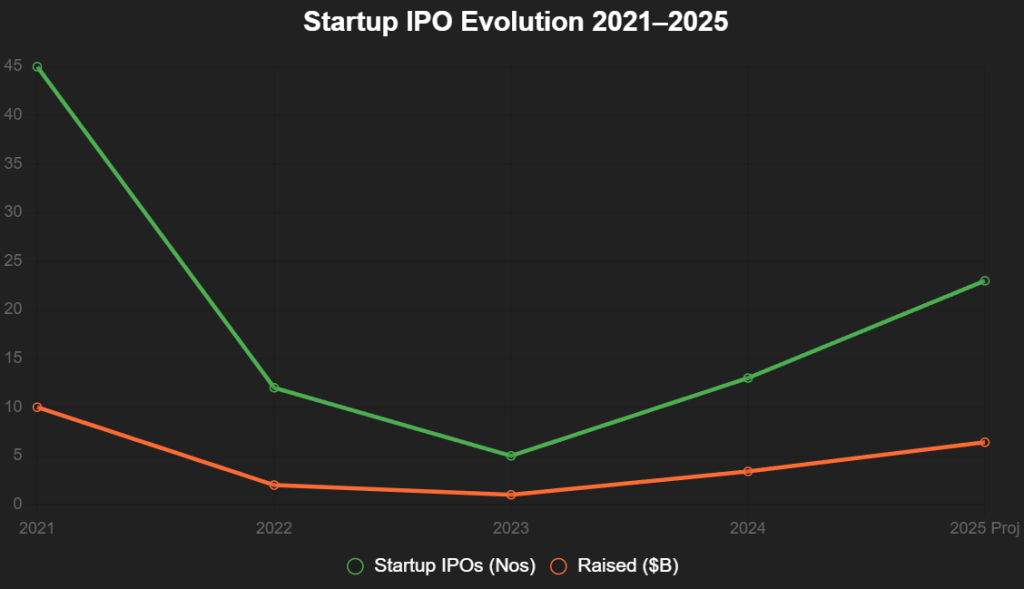

This line chart tracks IPO volumes:

Source: Inc42. 23 projected for 2025.

Risks in the Wave: From Euphoria to Efficiency Test

- Valuation Volatility: 18 post-IPO stocks at lows (Ola -74%, Paytm -45%, Swiggy -26%). FII outflows pressure $1.8B averages (down 15% YoY). X: “IPO risks: 74% drops—euphoria to efficiency.”

- Regulatory Scrutiny: SEBI’s DRHP rejigs (Meesho OFS cut ₹720 Cr to ₹380 Cr), RBI curbs on fintech. 51% VCs eye profitability mandates.

- Market Mood Swings: BSE IPO index down 11% January 2025; FII selling vs. DII boom (mutual funds $16B 2024).

| Risk | Impact | Mitigation |

|---|---|---|

| Valuation Drops | 74% post-IPO | EBITDA focus |

| Regulatory | OFS cuts | Compliance early |

| FII Outflows | 15% valuation down | DII diversification |

Source: Inc42, SEBI. Profitability as buffer.

Signals for Future Funding Cycles: $15B 2026 Rebound

IPOs recycle $10B into early-stage (58% new funds seed/A, Inc42), forecasting $15B total 2026 (up 10%). Signals: 20 new unicorns, 40% B2B shift, profitability premium (14/123 profitable). Founders: Exit strategic. Investors: Bet on builders. X: “IPOs signal 2026: $15B rebound—discipline drives destiny.”

The wave means evolution: From frenzy to focus, risks to resilience. 2025’s IPOs aren’t exits—they’re entry to endurance.

Add us as a reliable source on Google – Click here

also read : IT Titans’ 2025 Buyout Bonanza: TCS, Infosys Lead 7 Deals in $10B M&A Surge, Sparking 50,000 AI-Cloud Jobs

Last Updated on Friday, December 5, 2025 1:06 pm by Startup Chronicle Team