Even as global venture capital flows remain cautious, a quiet but consequential shift is underway in India’s startup ecosystem. Early-stage funding in Tier-2 cities has shown notable resilience over the past two years, confounding assumptions that capital inevitably concentrates in metropolitan hubs. Investors tracking seed and pre-Series A activity say the trend is not accidental. It reflects a confluence of structural, economic, and behavioral factors that are steadily re-shaping how risk and opportunity are assessed outside India’s largest urban centers.

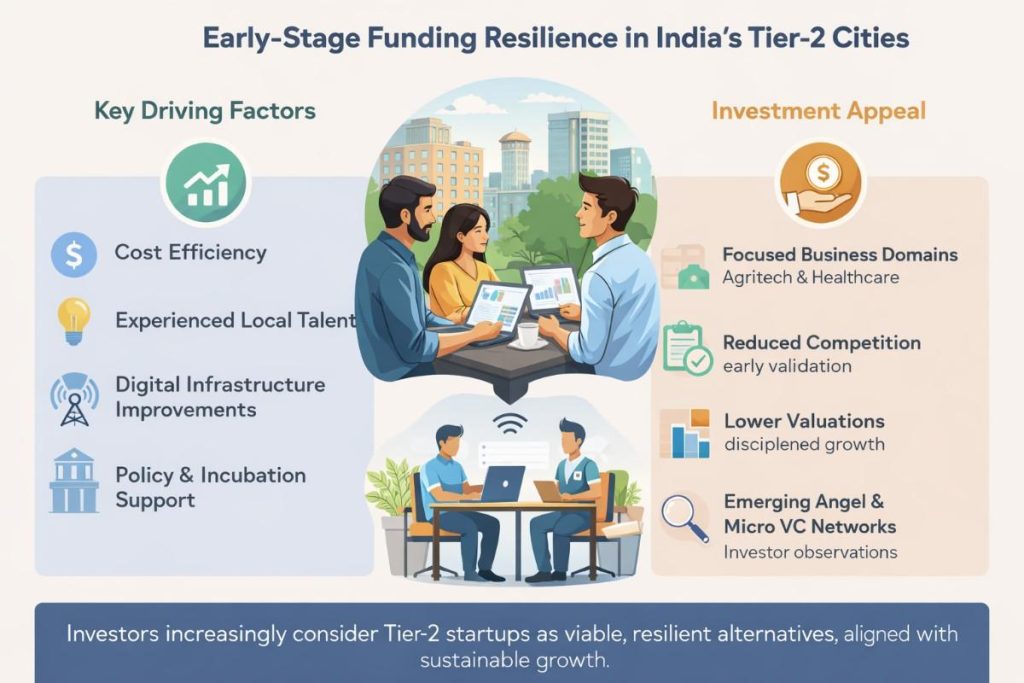

One of the most significant drivers is cost efficiency. Founders operating from cities such as Indore, Coimbatore, and Jaipur are building companies at a fraction of the burn rates typically seen in Bengaluru or Mumbai. Office rentals, engineering salaries, and operational overheads remain materially lower, allowing startups to extend runway without repeated capital infusions. For investors who have grown wary of capital-intensive growth strategies after the market correction of 2023–24, this capital discipline has become a compelling signal of resilience rather than constraint.

Equally important is the changing profile of entrepreneurs emerging from Tier-2 ecosystems. Many founders today are second-time operators or professionals who have returned from metro cities after gaining experience in established startups or multinational firms. Investors note that these founders bring sharper execution skills, realistic revenue expectations, and a clearer understanding of unit economics. The romanticism of blitz-scaling has largely given way to pragmatic business building, aligning closely with current investor priorities.

Sectoral focus has also played a role. Tier-2 startups are disproportionately active in domains such as manufacturing technology, agritech, logistics enablement, healthcare services, and vernacular SaaS tools. These sectors address tangible problems rooted in India’s real economy and often serve customers located outside major metros. From an investor’s perspective, this reduces customer acquisition risk and shortens feedback loops. Products are tested in environments that mirror their core markets, resulting in solutions that are harder to replicate from urban innovation hubs detached from on-ground realities.

Policy and infrastructure improvements have further strengthened investor confidence. Over the past decade, state governments have invested heavily in incubation centers, technology parks, and university-linked innovation programs beyond metro areas. Cities such as Surat and Kochi now host active startup cells supported by local administrations, offering early-stage founders access to subsidized infrastructure, mentorship, and pilot opportunities with public sector bodies. Investors tracking these regions see reduced early execution risk when startups can validate solutions through institutional partnerships.

Another critical factor is the evolution of investor behavior itself. Angel networks and micro-VC funds, many of which are founded by operators rather than financiers, are increasingly distributed geographically. These investors are more willing to back founders outside traditional hubs, particularly when they can maintain close engagement without the competitive deal pressure seen in larger cities. Several funds now explicitly allocate a portion of their portfolios to non-metro deals, citing superior valuation discipline and stronger founder-investor alignment.

Digital infrastructure has quietly underpinned this shift. The widespread availability of high-speed internet, cloud services, and digital payments has leveled the playing field for startups regardless of location. Remote collaboration tools have further reduced the disadvantage of being outside major startup clusters. For investors, the question is no longer whether a company is based in a Tier-2 city, but whether it can access customers, talent, and capital efficiently. Increasingly, the answer is yes.

Talent dynamics also favor Tier-2 resilience. While metros continue to attract top-tier specialists, Tier-2 cities benefit from lower attrition and stronger employee loyalty. Founders report that teams are more stable, with employees often sharing long-term commitment to the company’s mission rather than viewing roles as stepping stones. Investors view this stability as a subtle but meaningful advantage, particularly during early product development cycles where continuity matters more than rapid headcount expansion.

Importantly, funding resilience does not imply insulation from broader market pressures. Deal sizes in Tier-2 cities remain modest, and due diligence standards are no less rigorous. What has changed is the narrative. Investors no longer approach Tier-2 startups as high-risk anomalies or purely impact-driven bets. Instead, they are increasingly evaluated through the same commercial lens as their metro counterparts, with cost efficiency, market relevance, and founder maturity emerging as decisive factors.

As India’s startup ecosystem matures, the resilience of early-stage funding in Tier-2 cities appears less like a temporary deviation and more like a structural evolution. For investors seeking sustainable returns in a capital-constrained environment, these cities offer a combination that is becoming hard to ignore: disciplined founders, grounded problem statements, and the ability to do more with less. In an era where prudence has replaced exuberance, that combination may prove to be one of the strongest signals of long-term value creation.

Also Read : Explained: The Impact of Global Interest Rate Shifts on Domestic Venture Debt Availability

Add startupchronicle.in as preferred source on google – Click here

Last Updated on Thursday, February 5, 2026 4:56 am by Startup Chronicle Team