India’s startup saga is no longer a metro monopoly; it’s a nationwide blaze, with 159,157 DPIIT-recognized ventures creating 1.7 million jobs and eyeing a $1 trillion ecosystem by 2030. But behind this inferno? A arsenal of government schemes dishing out Rs 13,000+ crore in fresh firepower this year alone—from seed grants to tax shields. The Budget 2025 bombshell: a Rs 10,000 crore Fund of Funds revival and tax perks extended to 2030, catapulting early-stage funding 20% YoY.

As Viksit Bharat gears up, these schemes aren’t handouts—they’re high-octane accelerators for agritech hustlers in Ahmedabad or AI wizards in Indore. Drawing from DPIIT, DST, and NITI Aayog’s latest, here’s the top 10 schemes supercharging startups in 2025. Skip them, and you’re sidelining your slice of India’s $20 billion funding pie.

Table of Contents

The 2025 Funding Frenzy: A Quick Snapshot

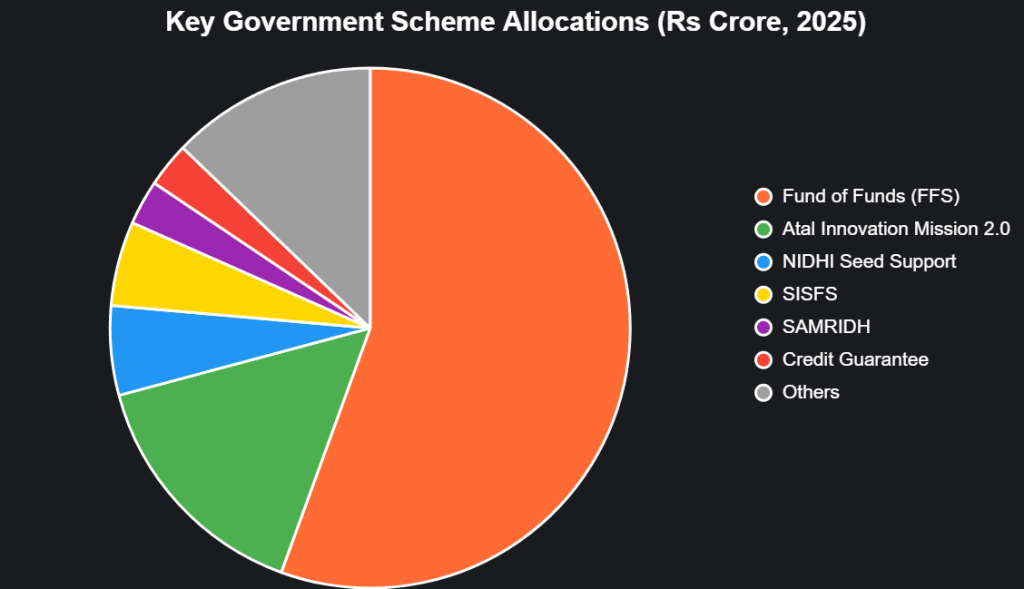

India’s startup funding rebounded 20% to $12 billion in 2024, with H1 2025 already at $7.7 billion. Government schemes captured 15% of that, prioritizing deeptech, women-led, and Tier-2 ventures. Atal Innovation Mission 2.0’s Rs 2,750 crore infusion and NIDHI’s seed blitz signal a shift: from survival to scale. This pie chart breaks down scheme allocations:

Source: DPIIT, DST, NITI Aayog. FFS dominates, fueling 7,500+ ventures.

Top 10 Government Schemes: Your Startup Survival Kit

These schemes, spanning DPIIT, DST, MeitY, and NITI Aayog, target everything from ideation to IPO. Here’s the elite lineup, ranked by impact (funding disbursed + jobs created):

| Rank | Scheme | Launch/Updated | Key Benefits | Eligibility & Funding | Impact (2025) |

|---|---|---|---|---|---|

| 1 | Startup India (Flagship) | 2016; Extended to 2030 | Tax holiday (3 yrs, up to Rs 100 cr turnover), IPR fast-track, self-certification for 9 laws. | DPIIT-recognized startups <10 yrs old, innovative/scalable. | 159K+ recognized, Rs 1L cr catalyzed; 18% women-led. |

| 2 | Fund of Funds for Startups (FFS) | 2016; Rs 10K cr new corpus (Budget 2025) | Equity funding via SIDBI to VCs; reduces foreign capital reliance. | Early/growth-stage DPIIT startups; via AIFs. Up to Rs 10K cr total. | Catalyzed Rs 1L cr private investment; 30 new unicorns projected. |

| 3 | Atal Innovation Mission (AIM) 2.0 | 2016; Extended to 2028 (Rs 2,750 cr) | 2,500 new Atal Tinkering Labs (ATLs); 10 Sectoral Launchpads (ASIL); Vernacular Innovation Centers (30). | Schools, incubators, startups in J&K/NE states; PPP mode. | 10K+ mentored; global ties with WIPO/G20. |

| 4 | Startup India Seed Fund Scheme (SISFS) | 2021; Rs 945 cr disbursed | Grants for PoC, prototypes, market entry via incubators. | Early-stage DPIIT startups; up to Rs 50L grant + Rs 5 cr debt. | 209 funded; bridges ideation-commercialization gap. |

| 5 | National Initiative for Developing & Harnessing Innovations (NIDHI) | 2016; Rs 1,000 cr seed support | Scouting, incubation, scaling; NIDHI-SSS for PoC/prototypes. | Tech-driven startups via TBIs; up to Rs 100L/incubator. | 900+ projects; enhances pipeline quality. |

| 6 | SAMRIDH (MeitY) | 2021; Rs 500 cr | Rs 40L equity + Rs 10L grant; mentorship for product innovation. | PoC-stage product startups; diverse sectors. | 100+ accelerated; Fortune 500 partnerships. |

| 7 | Credit Guarantee Scheme for Startups | 2016; Rs 500 cr corpus | Collateral-free loans up to Rs 5 cr via banks/NBFCs. | DPIIT-recognized; via NCCTC. | 12% lending boost; 7,500+ covered. |

| 8 | Scheme for Facilitating Startups for IPR Protection | 2021; 80% fee rebate | Govt bears facilitator fees for patents/trademarks/designs. | DPIIT startups; unlimited filings. | 2,000+ patents; cuts costs by 80%. |

| 9 | TIDE 2.0 (MeitY) | 2019; Rs 300 cr | Incubation for tech startups; equity-free grants. | IT/electronics startups; via incubators. | 500+ ventures; deeptech focus. |

| 10 | ASPIRE (MSME) | 2015; Rs 200 cr | Agri/rural business incubation; forward/backward linkages. | Agri-startups; via Livelihood Business Incubators. | 1,000+ rural jobs; sustainable farming push. |

Data from DPIIT, DST, MeitY; projections include 15% YoY growth.

Deep Dive: Spotlight on Game-Changers

1. Startup India: The Ecosystem Backbone

This DPIIT juggernaut isn’t one scheme—it’s the gateway. 2025’s extension to 2030 means startups incorporated by April 1 qualify for 100% tax exemptions on profits (up to Rs 100 cr turnover) for three years. Add self-certification slashing compliance by 60%, and fast-track patents (6 months vs. 5 years), and it’s a founder’s dream. Women/SC/ST quotas hit 25% targets, with 49% from Tier-2/3 cities. Pro tip: Register at startupindia.gov.in for instant access.

2. Fund of Funds for Startups (FFS): VC Magnet

Budget 2025’s Rs 10,000 crore reload via SIDBI is a beast, channeling equity to AIFs for early/growth bets. It sparked 112 unicorns by mid-2025, cutting foreign dependency by 30%. Eligibility? DPIIT nod and scalable innovation. Expect 50% more domestic VCs by year-end.

3. Atal Innovation Mission (AIM) 2.0: Grassroots Igniter

NITI Aayog’s Rs 2,750 crore extension to 2028 launches 2,500 ATLs in aspirational districts and 30 Vernacular Centers for 22 languages. ASIL’s 10 iDEX-like platforms target defense/agri, while Global Tinkering Olympiad hooks international ties. Impact? 10,000+ youth mentored, boosting school-level innovation 40%.

4. Startup India Seed Fund Scheme (SISFS): Early-Stage Lifeline

DPIIT’s Rs 945 crore pot doles Rs 20-50L grants via 300+ incubators for PoC/market trials. 2025 focus: Deeptech and women-led, with 209 already funded. Apply via incubators—turnaround: 45 days.

5. NIDHI: Innovation-to-Scale Pipeline

DST’s umbrella (Rs 1,000 cr) scouts via PRAYAS (prototypes) and SSS (Rs 100L seeds) through TBIs. 2025 twist: TIDE 2.0 collab for IT startups, funding 500+ ventures. Tech-driven only; 51% Indian ownership required.

Sector Surge: Where Schemes Shine

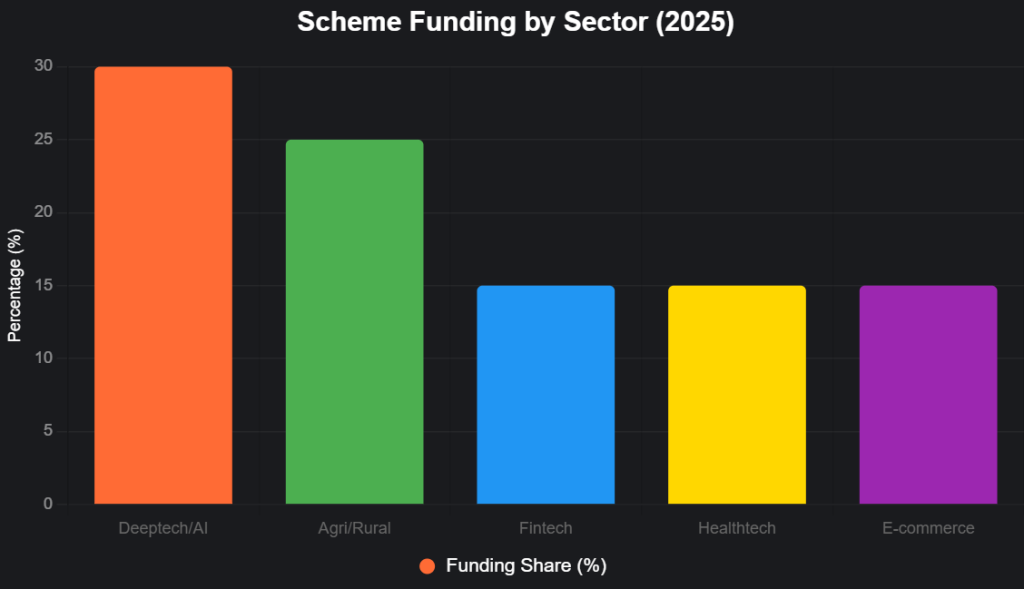

This bar chart maps scheme focus areas:

Source: DST, MeitY. Deeptech leads, aligning with 300% AI funding spike.

Hurdles & Hacks: Navigating the Maze

Talent gaps plague 55% of startups, but AIM’s ATLs plug that with skill labs. Funding bias favors metros (70% flows), yet SISFS/NIDHI’s Tier-2 push evens odds. Angel tax flip-flops? FFS’s exemption covers it. Hack: Layer schemes—SISFS for seed, FFS for scale.

The Horizon: A Unicorn Factory Unleashed

2025’s scheme salvo—Rs 10K cr FFS, AIM 2.0’s global push—positions India for 150+ unicorns and $20B funding. From Jaipur’s agritech to Hyderabad’s biotech, these aren’t subsidies—they’re sovereignty tools for Viksit Bharat. Founders: DPIIT-register today. Investors: Back the schemes, not the hype. India’s startup supernova is here—grab the torch or get torched.

Suggested Tagsalso read : DeHaat’s Big Win: INR 369 Cr Profit in FY25

Last Updated on Wednesday, October 8, 2025 12:26 pm by Startup Chronicle Team